< Back to the Resource Gallery

At this tax policy crossroads, begin preparing for tax changes in 2025

ARTICLE | September 12, 2024

Authored by RSM US LLP

Executive summary: Prepare for tax changes in 2025 by following the 2024 election

Businesses and individuals have reached a tax policy crossroads ahead of potentially sweeping tax law changes in 2025.

With a new president and Congress set to take office in January, conditions are ripe for legislative action that could remake the U.S. tax landscape. More than 30 provisions in the 2017 Tax Cuts and Jobs Act (TJCA) are scheduled to expire at the end of 2025, and a host of other tax provisions are potentially in play.

The nature and extent of any tax law changes will ultimately depend on the balance of power in Congress, where margins figure to remain slim, as well as on who wins the White House. The Sept. 10 presidential debate between Vice President Kamala Harris and former President Donald Trump underscored this crossroads while commencing the sprint to Election Day on Nov. 5.

Although the exchange between the candidates featured few tax policy details beyond those already known, the discussion reflects the early stages of a longer, and more protracted, tax policy marathon—with major tax changes potentially at the finish line sometime in 2025.

Before the general election, businesses and individuals can work with their tax advisor in the following ways to equip themselves to make smart, timely decisions once the tax policy outlook becomes clearer:

- Monitor candidates’ tax proposals

- Identify potential tax changes that could affect their business objectives, individual tax position and estate planning goals

- Begin to model potential cash flow and other impacts of significant proposals

- Create and execute a 2024 year-end tax planning strategy

- Below, we discuss each candidate’s notable tax proposals, explain the crucial power dynamics at stake in the election, and suggest actions that businesses and individuals should consider at various stages of the legislative cycle.

The tax policy crossroads

The candidates’ tax proposals continue to emerge through speeches by the candidates themselves and campaign press releases. Vice President Harris is positioning her campaign as generally supportive of the tax proposals in President Joe Biden’s budget for the 2025 fiscal government year, albeit with some specific deviations.

Harris tax proposals

Federal tax proposals for which either Harris or her campaign have expressed support include:

- A general commitment that no individuals with income below $400,000 will see a tax increase

- A corporate income tax rate of 28%, up from the current rate of 21%

- An increase in the federal long-term capital gains tax rate from the current 20% to 28% for taxpayers earning $1 million or more per year (and a potential all-in capital gains tax rate of 33%, assuming an increased net investment income tax rate of 5%, where applicable.)

- An expansion of the start-up expenditure deduction to $50,000 from the current $5,000

- Exemption of tip income from income tax

- An annual tax of 25% on total income for those with wealth greater than $100 million; potentially, this could include unrealized capital gains

- Quadrupling the tax on stock buybacks from 1% to 4%

- An expanded child tax credit of $6,000 for newborns and a smaller increased child tax credit for other children

- Up to $25,000 in assistance for first-time homebuyers

- An enhanced Earned Income Tax Credit

Trump tax proposals

Meanwhile, Trump has announced support for the following federal tax changes:

- Lowering the corporate income tax rate from 21% to 15% for certain qualified businesses that make their products in the United States and 20% for all other corporations

- Exempting tip income from income and social security taxes

- Exempting social security benefits from income taxes

In addition, Trump is looking to generally extend the TCJA, which includes more than 30 tax provisions scheduled to sunset at the end of 2025. Extending the TCJA would include, among other things:

- Extending current individual tax rates, brackets and the standard deduction

- Retaining a cap on certain itemized deductions, such as the state and local tax deduction

- Limiting the number of taxpayers subject to the individual alternative minimum tax

- Providing a 20% qualified business income deduction for pass-through entities

- An increased lifetime estate tax exemption

The nonpartisan Congressional Budget Office has estimated that extending the TCJA would add $4.6 trillion to the federal deficit over the ensuing decade. On the other hand, allowing it to expire would result in some de facto tax increases for certain individuals and businesses. Avoiding either outcome figures to be an impetus for many lawmakers to pursue new tax legislation.

In that scenario, many other existing tax provisions of the Internal Revenue Code could be subject to negotiation and change. That includes three business provisions of particular importance that were enacted as part of the TCJA and went into effect in either 2022 or 2023:

- Capitalization and amortization of research and experimental expenditures

- A more stringent business interest deduction limitation

- A phase down of 100% bonus depreciation

The role of Congress

Any tax law changes in 2025 will depend on the balance of power in the 119th Congress. As evidenced in the current Congress, slim margins affect legislative outcomes, and party control does not assure outright consensus.

In the House of Representatives, where Republicans currently have a very slim majority, all 435 seats are up for election on Nov. 5. In the Senate, where Democrats have a narrow majority, 34 (23 Democratic and 11 Republican) of 100 seats are up for election.

If either party wins control of the White House, Senate and House, it would likely turn to the budgetary procedure known as reconciliation to fast-track passage of its tax priorities. Even in that circumstance, however, the margins of the majorities matter. A budget reconciliation bill can pass in the Senate with 51 votes (which, in the case of a 50-50 tie, would include a tiebreaking vote from the vice president); other legislation in the Senate generally requires 60 votes to move forward.

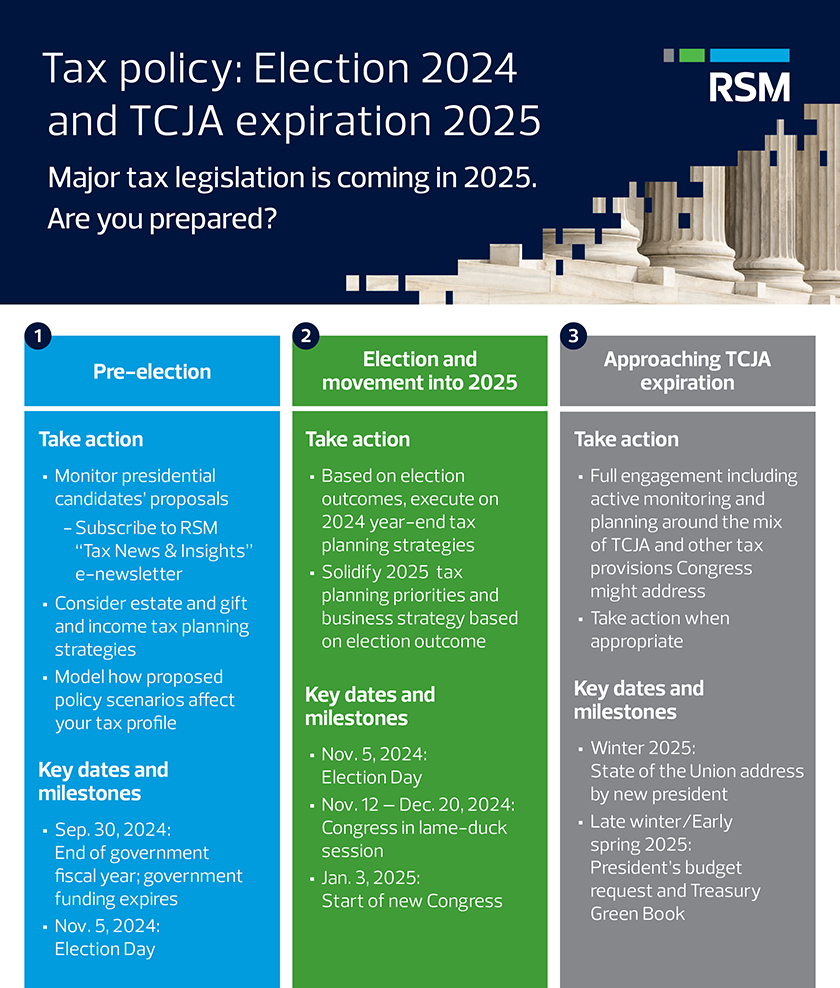

Timeline for taking action

The 2024 election and 2025 TCJA sunset provisions can be overwhelming for taxpayers to follow. As we move toward Election Day on Nov. 5 and the seating of the 119th Congress in early January, here are some steps companies and individuals can take with their tax advisors to prepare to make smart, timely decisions once tax policy outcomes become clearer.

Moving forward at the crossroads

Every election season brings potential changes to tax laws, but the 2024 election could be the first step toward a transformative tax policy event in 2025. The breadth of tax provisions, both temporary and permanent, that could become part of the political discourse is all-encompassing.

Regardless of the outcome of the 2024 election, 2025 is shaping up to be an active, uncertain period. Your tax advisor can help you stay updated about legislative developments and plan for policy outcomes that affect your cash flows and tax obligations.

Let’s Talk!

Call us at (800) 624-2400 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Dave Kautter, Matt Talcoff, Ryan Corcoran, Fred Gordon, Amber Waldman, Tony Coughlan and originally appeared on 2024-09-12. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/tax-alerts/2024/tax-policy-prepare-for-tax-changes-in-2025.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

A full-service accounting and financial consulting firm with locations in Bay City, Clare, Gladwin and West Branch, Michigan.

Opening its doors in 1944, Weinlander Fitzhugh is a full-service accounting and financial consulting firm with locations in Bay City, Clare, Gladwin and West Branch, Michigan. WF provides services such as, accounting, auditing, tax planning and preparation, payroll preparation, management consulting, retirement plan administration and financial planning to a variety of businesses and organizations.

For more information on how Weinlander Fitzhugh can assist you, please call (989) 893-5577.